Join Chubb Life Insurance Today and Enjoy Exclusive Member Benefits

Join Chubb Life Insurance Today and Enjoy Exclusive Member Benefits

Why Chubb Life Insurance?

When it comes to protecting your loved ones and securing your financial future, Chubb Life Insurance is the premier choice. With our comprehensive coverage and exclusive member benefits, we go above and beyond to provide peace of mind and financial security for you and your family.

Exclusive Member Benefits

At Chubb Life Insurance, we believe that being a member has its perks. When you join our family, you gain access to a range of exclusive benefits that are designed to enhance your coverage and give you added value.

1. Cash Value Accumulation: Unlike many other insurance providers, Chubb Life Insurance policies come with the added advantage of cash value accumulation. This means that as you pay your premiums, a portion of the money goes into a separate account that grows over time, building cash value that you can use for future needs.

2. Flexible Premium Payment Options: We understand that everyone’s financial situation is different. That’s why we offer flexible premium payment options that cater to your specific needs. Whether you prefer annual, semi-annual, quarterly, or monthly payments, we’ve got you covered.

3. 24/7 Customer Support: Your satisfaction is our top priority. Our dedicated customer support team is available round the clock to assist you with any insurance-related queries or concerns you may have. Rest assured, we are just a phone call away.

Frequently Asked Questions (FAQs)

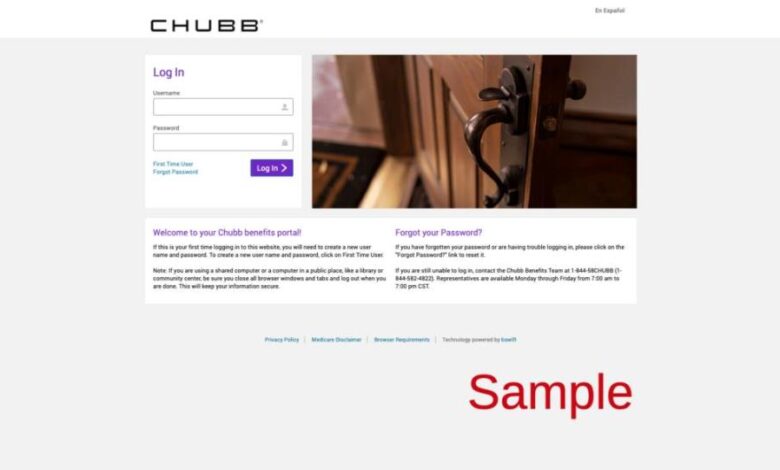

1. How do I join Chubb Life Insurance?

Joining Chubb Life Insurance is simple and straightforward. You can start by visiting our website and filling out our online application form. Alternatively, you can contact our customer support team, and they will guide you through the enrollment process.

2. What factors should I consider when choosing a life insurance policy?

Choosing the right life insurance policy is an important decision. Some factors to consider include your age, financial obligations, desired coverage amount, and future financial goals. It’s also a good idea to consult with a knowledgeable insurance agent who can guide you through the process and help you make an informed decision.

3. Can I customize my life insurance coverage?

Absolutely! At Chubb Life Insurance, we understand that everyone’s needs are different. That’s why we offer customizable coverage options to ensure that your policy aligns perfectly with your unique requirements. From coverage amounts to policy riders, we provide flexibility to meet your specific needs.

4. Can I cancel my life insurance policy if I change my mind?

Yes, you can cancel your life insurance policy at any time. However, it’s important to note that canceling a policy may result in the loss of any accumulated cash value, and you may not be eligible for a refund of the premiums already paid. Before canceling, it’s advisable to speak to a Chubb Life Insurance representative to explore other options that may better suit your changing circumstances.

Conclusion

When it comes to protecting your loved ones and securing your financial future, Chubb Life Insurance offers comprehensive coverage and exclusive member benefits that are second to none. With our customizable options, flexible payment plans, and dedicated customer support, joining Chubb Life Insurance is a decision you won’t regret. Take the first step towards a secure future and join Chubb Life Insurance today.

Remember, your loved ones deserve the best protection, and Chubb Life Insurance is here to provide it. Don’t wait; take advantage of our exclusive member benefits and join us today!